The Psychology of Money Summary

Micro summary

The psychology of money explains the soft skill of thinking and dealing with money rather than just the hard numbers. It explains how your behavior shapes your financial decisions and how to craft a financial plan that works for you.

Are we crazy?

We do crazy things with money because we’re newbies who have different life experiences.

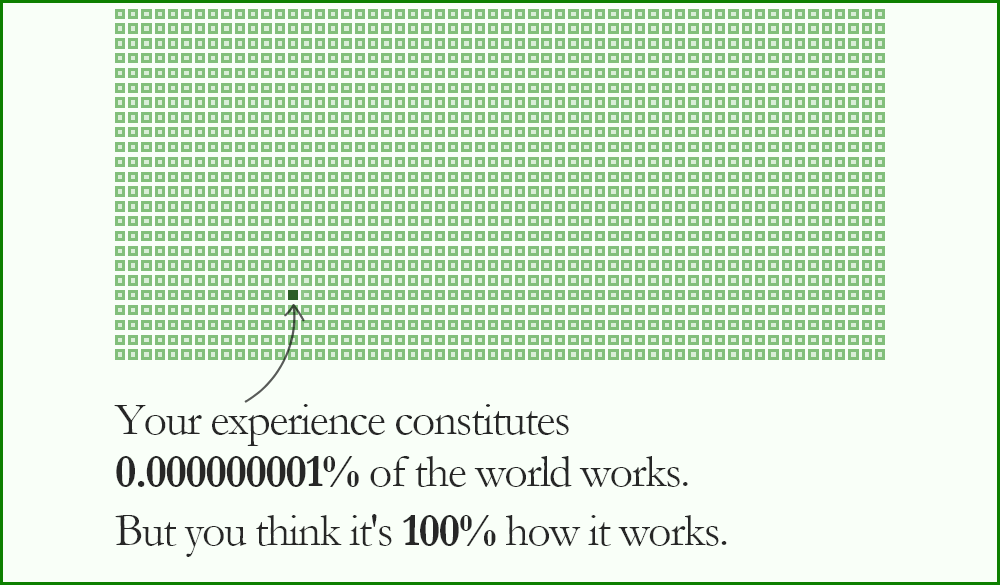

Different experiences

Two people born in different countries, in different economies, earning different incomes, who had opportunities and different strikes of luck will have two different narratives about how the world works and how they should deal with money. Even one variable will change your experience which will change your perception and your behavior about money.

Two people born in different countries, in different economies, earning different incomes, who had opportunities and different strikes of luck will have two different narratives about how the world works and how they should deal with money. Even one variable will change your experience which will change your perception and your behavior about money.

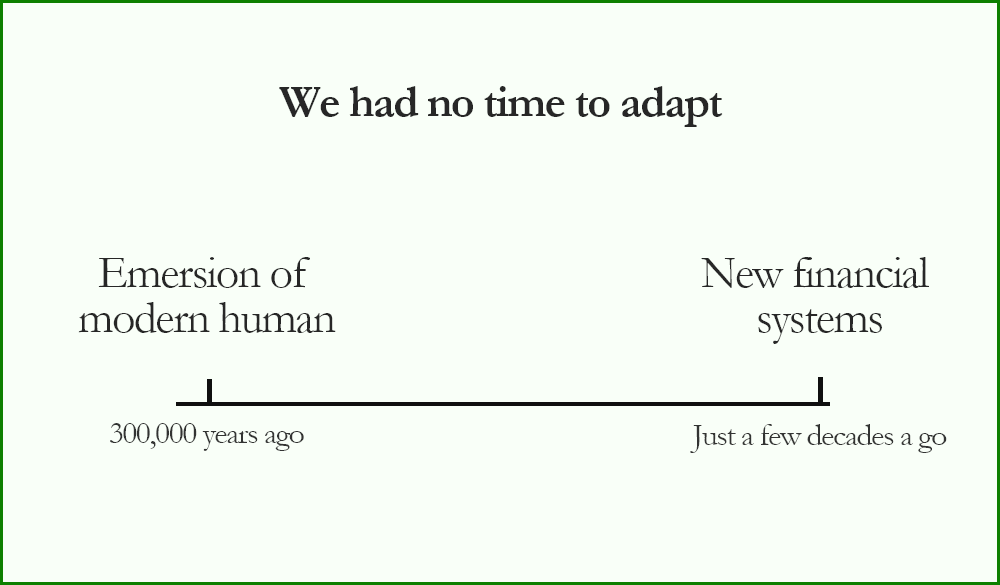

Newbies

We are new to this game. Retirement accounts are relatively new concepts.

The 401(k) was created in 1978. Roth IRA has been created in 1998. Index funds are 50 years old.

From an evolutionary perspective, we had almost no time to adapt to these new concepts. It’s still counterintuitive to us.

We are new to this game. Retirement accounts are relatively new concepts.

The 401(k) was created in 1978. Roth IRA has been created in 1998. Index funds are 50 years old.

From an evolutionary perspective, we had almost no time to adapt to these new concepts. It’s still counterintuitive to us.

That’s why we do things we’re not supposed to with our own money.

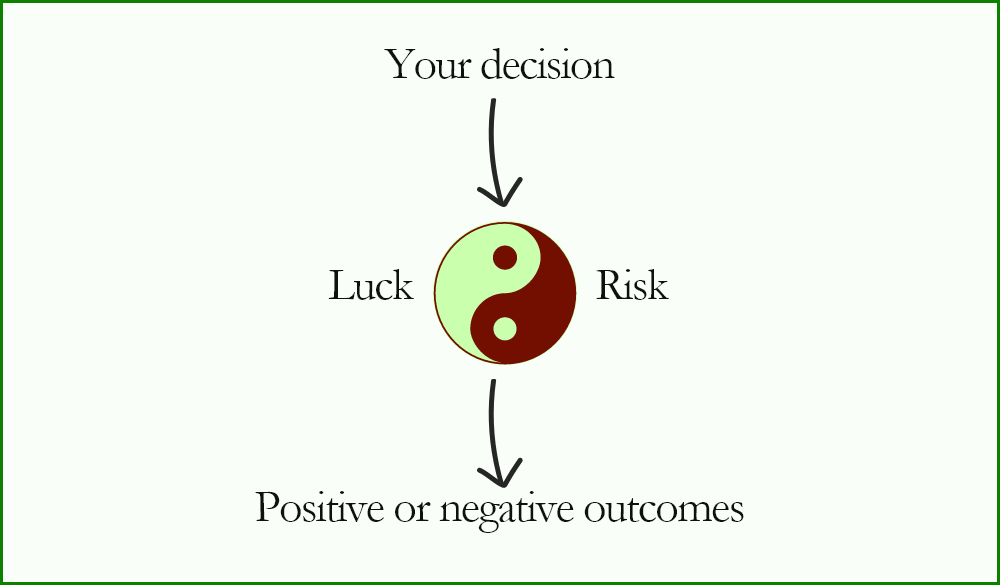

The probability game

You can’t control risk and luck. Accept it and avoid decisions with extreme risk so you can get lucky in the long run.

Good and bad financial outcomes are influenced by luck and risk. Not just your decisions. Bill Gates had a computer in his high school. That’s a one-in-a-million chance. His best friend, Kent Evans, who could’ve co-founded Microsoft with him, died in a mountaineering accident. That’s a one-in-a-million chance.

Sometimes, your decision, which on paper had a high probability of creating a good outcome, creates a bad one.

So what to make of this?

Don’t study the extreme stories:

Extreme outcomes are much more likely to be influenced by extreme strikes of luck or risk. The stories of the Warren Buffets of the world contain little insight.

Study broad more repeatable patterns of success.

You’ll get farther by studying the masses instead of the extreme cases.

Make sure you play for long

Accept the fact that luck and risk will influence your decision. Make sure you don’t go all in. Otherwise, you can be ruined. Build a safety net so you can continue playing until you win.

Greed is the enemy

“Yes, but I will have something he will never have… enough” (Quote from the book)

“Yes, but I will have something he will never have… enough” (Quote from the book)

Draw a line you shouldn’t cross. This is the “enough” goalpost. Once you earn more money, don’t raise your lifestyle level.

Do not compare yourself with others. Your income can always be perceived as “not enough”. This can push you to self-destruction.

Do not risk what matters most:

- Family

- Friends

- Freedom

- Happiness

- Reputation

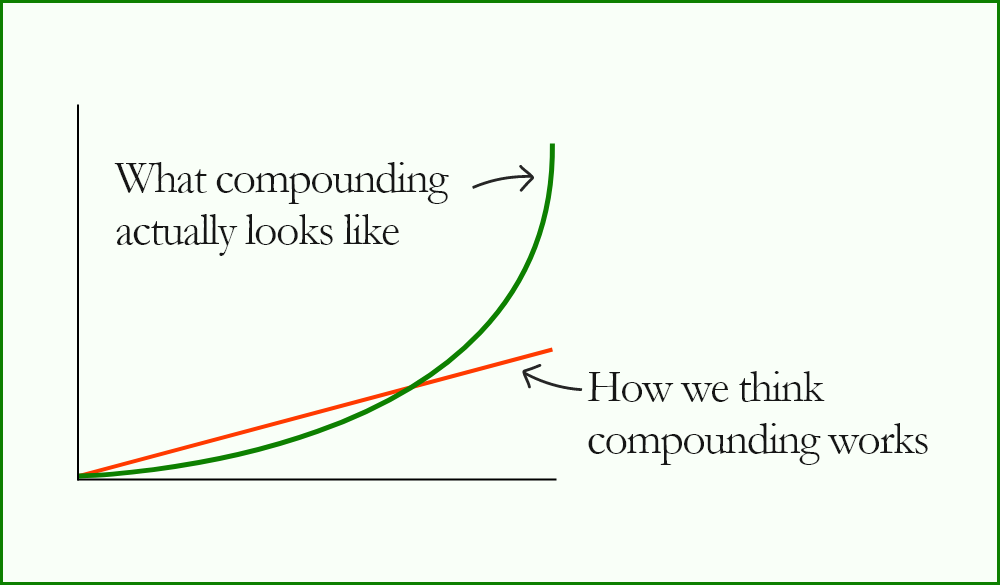

Compounding is counterintuitive

We think in a linear way. Wealth gets created exponentially.

Our minds are built to perceive change in a linear manner. Our minds cannot intuitively understand how money can grow exponentially by investing consistently with good returns for a long period of time. That’s why people chase investment opportunities with huge returns. Time is much more valuable than any investing knowledge. Because the longer the play, the more the returns compound and wealth get formed.

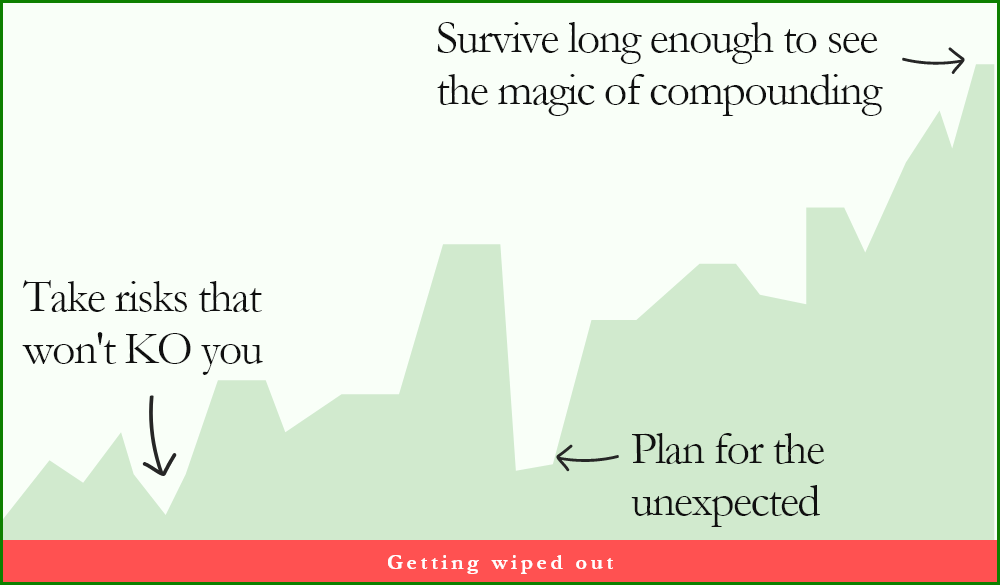

The longevity game

Getting money requires risk, keeping it requires the opposite

Getting money requires risk, keeping it requires the opposite

You need humility and a relatively good amount of frugality to keep your wealth.

Keeping your money is a longevity game

Longevity is the result of humility, patience, and composure when things go wrong. This could mean not pulling out when the market crashes. It also means resisting the urge to take more risks than you can handle. Longevity means continuing to play for decades without getting wiped out. Once you play the long-term game, compounding will do its magic.

Expect the unexpected

Be optimistic but extremely careful. Optimism is what will keep you going. Being extremely careful is what will help you survive any hardship along the way.

Tails

Amazon makes most of their revenue from very few products. So do Netflix and many other businesses. Most of the products will fail miserably. Embrace that. That’s because some of them will succeed spectacularly.

Amazon makes most of their revenue from very few products. So do Netflix and many other businesses. Most of the products will fail miserably. Embrace that. That’s because some of them will succeed spectacularly.

You will do a lot of bad and very average investments. You need to make sure that the good ones will take care of the rest. Tails drive almost everything.

You don’t need to make great decisions all the time. In fact, you can’t. But that’s okay.

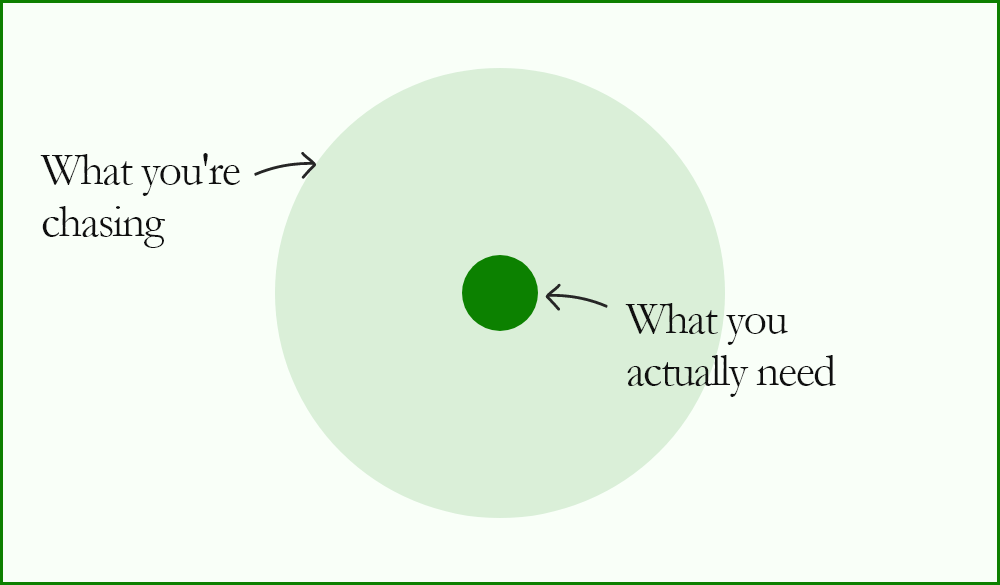

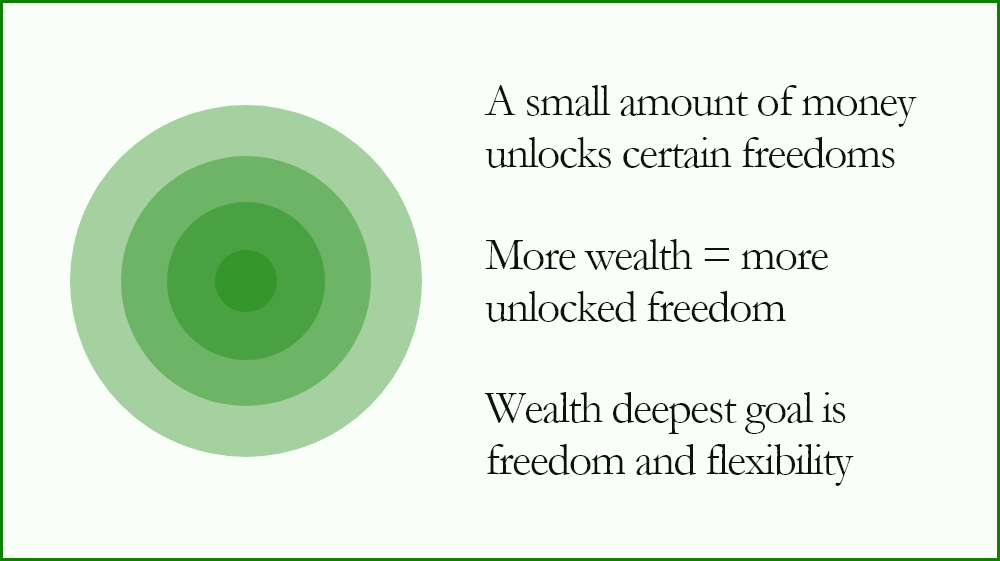

Freedom before impressive numbers

Wealth buys you flexibility and freedom. That’s what matters most.

People are happier when they have a sense of control over their time. The best thing wealth can do for you is to give you the freedom to do what you want. Wealth will enable you to choose a meaningful career instead of a job that pays the most. It gives you the flexibility to make the right choice for you, without getting pressured and forced to choose other options. It gives you the ability to face emergencies without too much worry. It helps you not sacrifice spending time with your family and friends.

Wealth can be a small amount of money that enables you to reach any of these goals. It can vary depending on the level of freedom you’re after. Freedom is what matters most.

You don’t need to impress them

Control your ego

You can’t buy respect. A nice car will attract people’s attention. But they’re impressed by the car itself, more than you being the owner. Possessions won’t get you respect and love. That doesn’t mean you shouldn’t want them. Just don’t chase them to prove something to others.

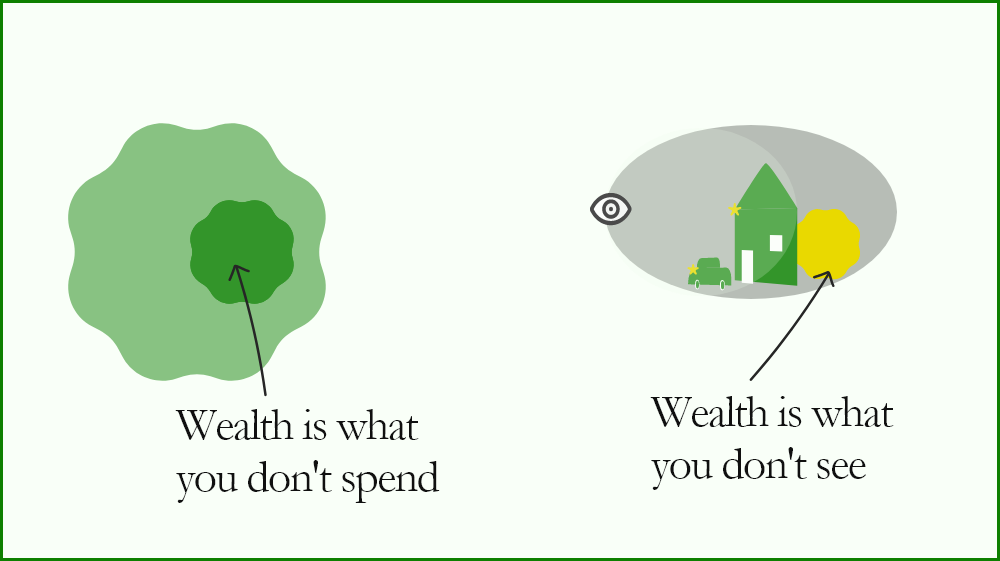

Wealth is the “assets not yet spent”

Don’t imitate the rich

Most of us learn by imitating the successful. But the problem is that it’s hard to see who’s actually wealthy. A lot of people with nice things aren’t really wealthy. Some are. But you can’t tell the difference. You don’t see their savings or investments. You can’t see their assets.

That’s why you shouldn’t blindly imitate those who appear to be wealthy.

Most of us learn by imitating the successful. But the problem is that it’s hard to see who’s actually wealthy. A lot of people with nice things aren’t really wealthy. Some are. But you can’t tell the difference. You don’t see their savings or investments. You can’t see their assets.

That’s why you shouldn’t blindly imitate those who appear to be wealthy.

Save for the storm

Saving is simple. Saving is hard.

Wealth= Income - Expenses It’s simple but hard to accumulate. You need to control how you behave with money to keep those expenses down and stop the urge to want more income. To do that, you need to:

- Be (relatively) frugal

- Understand your needs (and try to stop at that point)

- Tame down your ego and let go of what others think of you

- Save for a rainy day. Not just for a certain goal like a vacation, a house, etc.

- Save so you can have the flexibility and the freedom to wait for good opportunities.

You save more once you understand that wealth is something you define. It’s what you don’t spend once you satisfy your needs so you can be both free and secure.

Just good enough works better for humans

What works for you beats what works in math

We’re emotional creatures. Realistically, we have neither the interest nor the discipline to stick with the mathematically optimal path. But that’s okay. The alternative is to just do good enough to play the long-term game.

We’re emotional creatures. Realistically, we have neither the interest nor the discipline to stick with the mathematically optimal path. But that’s okay. The alternative is to just do good enough to play the long-term game.

A strategy that provides you with more joy and passion will help you play the game longer. If you pick stocks of companies you care about, you’re more likely to stick with them in the long run. Choosing a strategy you like looks less optimal. But if that helps stick with it in the long run, that subjective passion becomes an advantage. If you stick with it, you’ll give compounding the fuel it needs: more time.

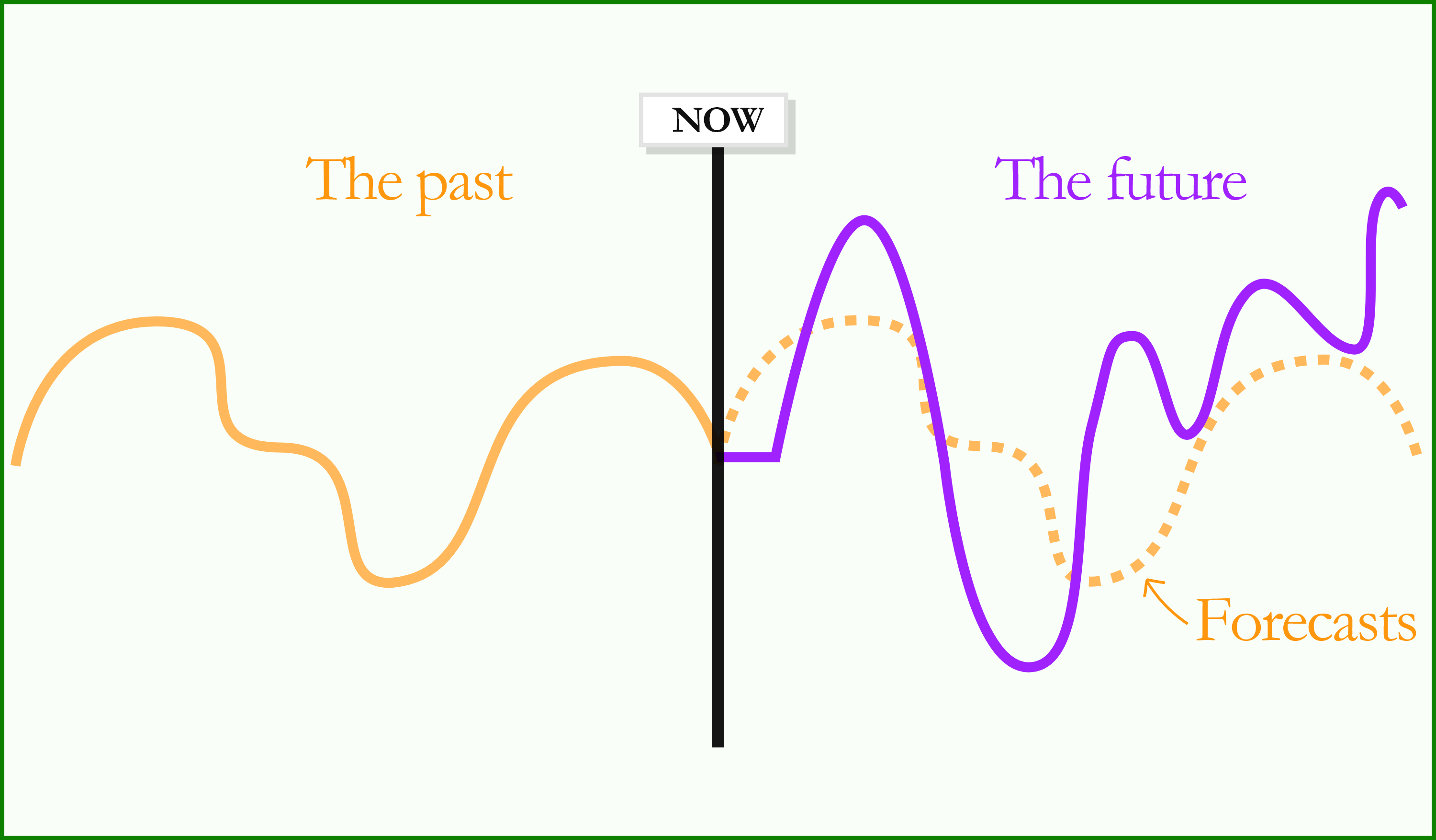

History doesn’t repeat itself

History isn’t a fortune teller

History can teach us how people behave when dealing with money. But it fails to tell us what the future will look like. There’s a big difference between what worked decades ago and what works now. There are obsolete tactics and strategies. There are a lot of new systems that didn’t exist before (401(k), Roth IRA, index funds, venture capital, etc). Many events like WW2 for example had huge impacts on the economy. This big difference between what happened in the past and what the unexpected can happen in the future leaves us with no useful insights. So beware of using the past as a plan for the future and consider building a safety net.

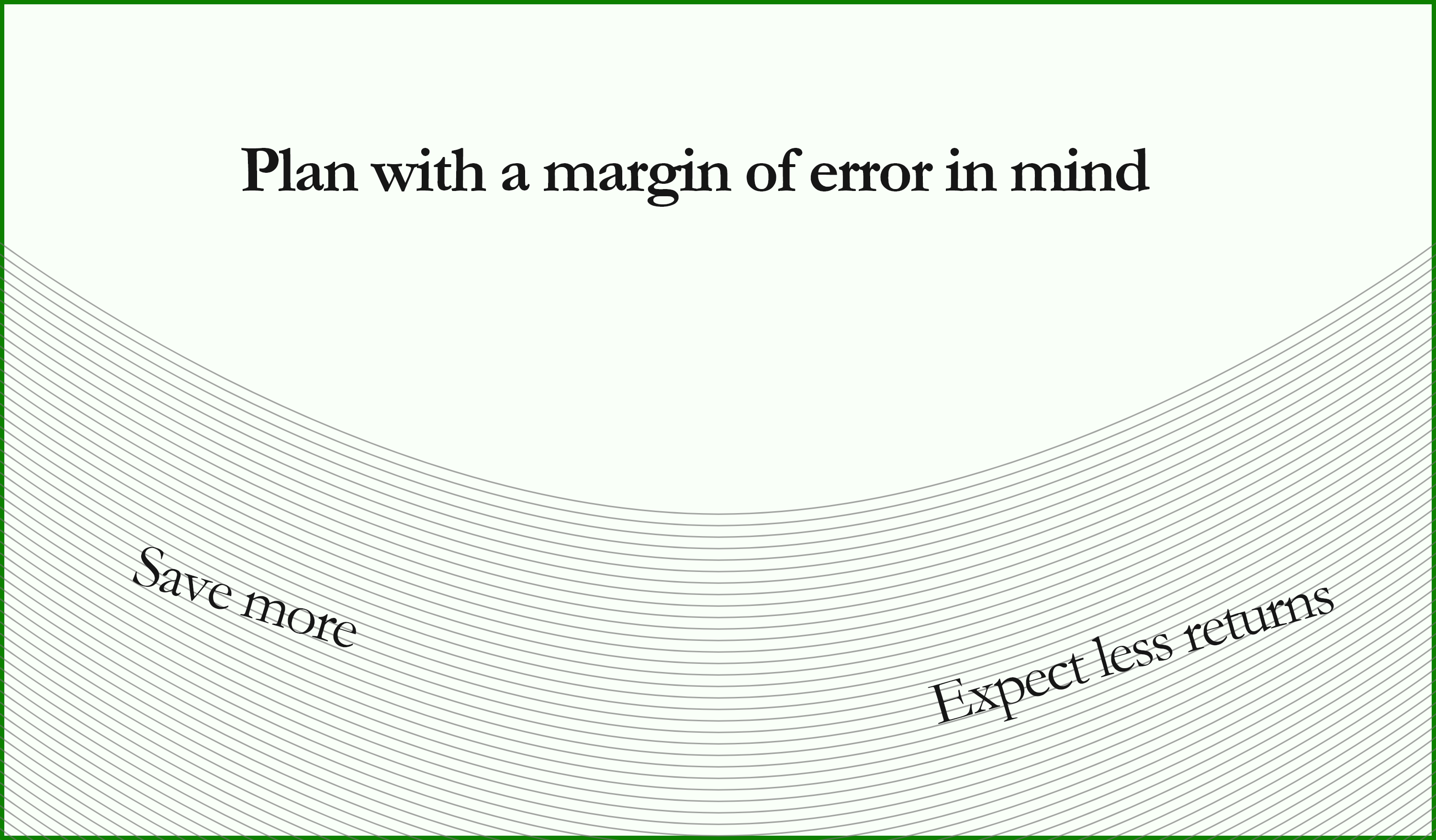

The safety net

Plan with a margin of error

We don’t know what the future holds. We should have plans. But most importantly, we must plan for when things go wrong, which they do.

That’s why you need to leave some room for error.

The author shares some examples from his own decisions:

- For his index funds, he expects 1/3 less returns.

- He saves a lot. Much more than he can estimate for expected risks.

We all change

Embrace change when it comes

We underestimate how much we will change in the future. But we all do.

Our goals and wants change too. Our long-term plans, which are essential, can become obsolete in the long run.

So try not to pick extreme lifestyles. You’ll most probably regret working extreme hours for a high income because of the materialistic lifestyle you chased. But you’ll also most probably regret working a what-used-to-be-fullfilling low-income job because now you don’t have enough to start a family or retire.

We underestimate how much we will change in the future. But we all do.

Our goals and wants change too. Our long-term plans, which are essential, can become obsolete in the long run.

So try not to pick extreme lifestyles. You’ll most probably regret working extreme hours for a high income because of the materialistic lifestyle you chased. But you’ll also most probably regret working a what-used-to-be-fullfilling low-income job because now you don’t have enough to start a family or retire.

Embrace your change and make a new plan with new goals accordingly.

Invisible prices

Be fine with market volatility

Market volatility is the invisible price you pay. You’ll pay in fear, uncertainty, and doubt.

You need to be OK with paying that fee and not thinking about it as a fine.

This way you can play the long-term game.

Market volatility is the invisible price you pay. You’ll pay in fear, uncertainty, and doubt.

You need to be OK with paying that fee and not thinking about it as a fine.

This way you can play the long-term game.

Pick your game

Your game, your goals, your rules. My game, my goals, my rules.

Investing is not one game. It’s a collection of different games. Investing for 30 years, 10 years, 1 year, or 1 day (day trading) are different games. If you’re playing the long-term game, you shouldn’t be bothered by a dip that happened today or this year. Your goal is to get consistent returns that will compound over the years. But that’s not the same game of a day trader or someone who wants to cash out after a year.

Pick your own game. Understand the rules of your own game.

When a long-term investor gets influenced by a trader playing a short-term game, they get hurt. When most of the ‘stock X’ investors become short-term ones, a bubble forms. The valuation of the stock will go through the roof. This attracts investors playing the long-term game. But once the bubble burst eventually, it’s the investor playing the long-term game who will get hurt.

Define who you are as an investor, your goals, and the rules of your game. Then play accordingly without the influence of other types of investors playing different games.

Pessimism

Pessisim is more attractive

Pessimism weighs much more than optimism. A pessimistic story or statement is more sticky and attention-grabbing. But we seem to dismiss optimistic stories. From an evolutionary perspective, the higher weight of pessimism was what helped us survive in the jungle for millions of years.

in finance, if a stock goes up by 1%, we don’t care much. If it goes down by 1%, we pay much more attention. That’s the asymmetry between optimism and pessimism.

It also makes sense because the probability of something very bad happening is much higher than a miracle happening. Great things happen slowly but disasters happen at once.

Understand that people are more driven by pessimism. It’s useful because it reduces the expectations. It makes good things happening more enjoyable.

The power of stories

Stories are more powerful than statistics

There are a lot of things we don’t know about how the world works. That’s the way we make sense of things with the stories we tell ourselves. These stories fill the gaps in our knowledge. If we admit that these gaps exist, that means we admit that we can’t control the world. So we prefer stories because they make us feel like we’re in the driver’s seat.

Your view of the world and the decisions you make will fall into your own story. That’s not optimal, but how we humans function. So do what makes sense for you.

If you liked the summary, please consider reading the book.